Aug 04, 2021

38 secs

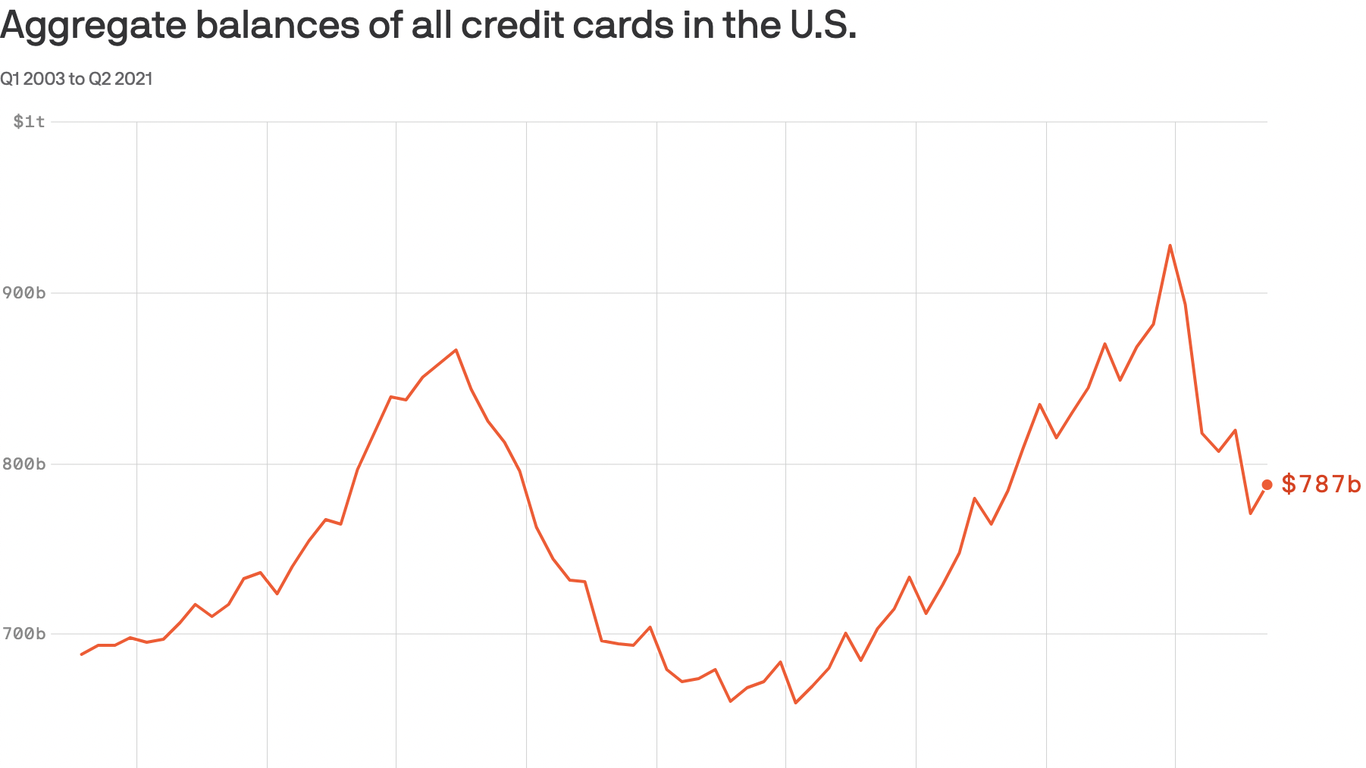

Please enter a valid email.Please enter a valid email.Please enter a valid email.Please enter a valid email.Please enter a valid email.Credit card balances recently ticked higher, but remain well below pre-pandemic levels.Why it matters: Higher credit card balances are considered a rough proxy for spending activity and consumer confidence.By the numbers: According to the New York Fed’s Household Debt and Credit Report, credit card balances increased by $17 billion in Q2 to $787 billion.Zoom out: The fact that spending is elevated while credit card debt is depressed can be explained by the massive savings accumulated during the early part of the pandemic.The bottom line: Just because credit card balances remain depressed doesn’t mean consumers aren't spending.