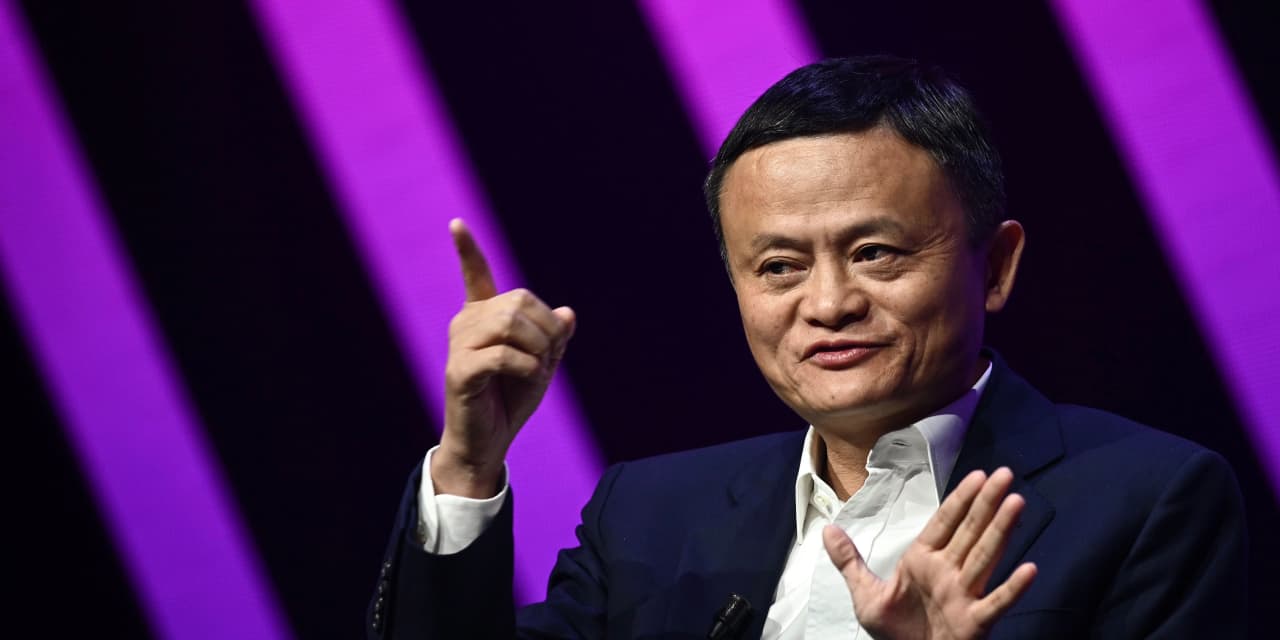

The Alibaba Group Holding Ltd.–affiliated company controlled by Jack Ma has filed paperwork to list its shares concurrently on the Hong Kong and Shanghai exchanges.

Ant, which runs China’s immensely popular Alipay mobile wallet, is reportedly looking to rake in at least $35 billion through an offering that could value the company at $250 billion, according to Bloomberg. .

That would make Ant’s offering larger than that of Saudi Aramco, which brought in more than $25 billion in the biggest IPO to date.

A valuation of $250 billion would mean Ant is worth more than Bank of America Corp.

The company is best known for its mobile-payments offering, but it aims to be a one-stop financial hub that also provides access to wealth management, investing and insurance services.

Analysts view the payments portion of the business as a gateway that brings users in to Ant’s more complex offerings. .

Unlike Western mobile wallets, Ant’s platform touches on nearly all aspects of one’s financial life.

Apple Pay do, offering services for everything from payments to credit to insurance to investments within Alipay, which the company calls a “ubiquitous super app.†Ant counts more than a billion annual active users for the Alipay app and 711 million monthly active users. .

App-based payments are commonplace in China, even for in-person transactions, and this is perhaps the most well-known aspect of Ant’s business.

But other areas of the business are more interesting, Bernstein’s Kwek argued in a note to clients, particularly the company’s credit business, in which Ant originates loans that are almost entirely underwritten by financial partners, giving the company useful loan insights without requiring it to take much balance-sheet risk. .

The credit business is “maybe the gem†of Ant’s business, Kwek wrote.

Ant lists synergies with Alibaba among its business strengths in its filing. .

Ant generated RMB 120.6 billion ($17.7 billion) in revenue over the course of 2019, up from RMB 85.7 billion a year earlier.

The company’s latest annual total consisted of RMB 51.9 billion in digital-payments revenue and RMB 41.9 billion in credit-technology revenue.

Ant added RMB 8.9 billion in revenue from insurance technology and RMB 17 billion from investment technology.Â

The company posted a non-IFRS profit of RMB 24.2 billion for 2019, after recording a loss of RMB 18.3 billion in the prior year

The real question for Kwek is what Alibaba will need to do to maintain its edge

The biggest pain point for Alibaba might come from the Chinese government, which has put up roadblocks to Ant’s growth in the past

and Hong Kong, Ant is aiming for a dual listing of its shares in Hong Kong and Shanghai amid tensions between the U.S

Because Ant’s shares are expected to list in Hong Kong and Shanghai, the process of buying these stocks isn’t as straightforward for U.S

said that clients could access stocks listed in Hong Kong but not those listed in Shanghai