The company was initially planning to close the Hong Kong book at 5 p.m.

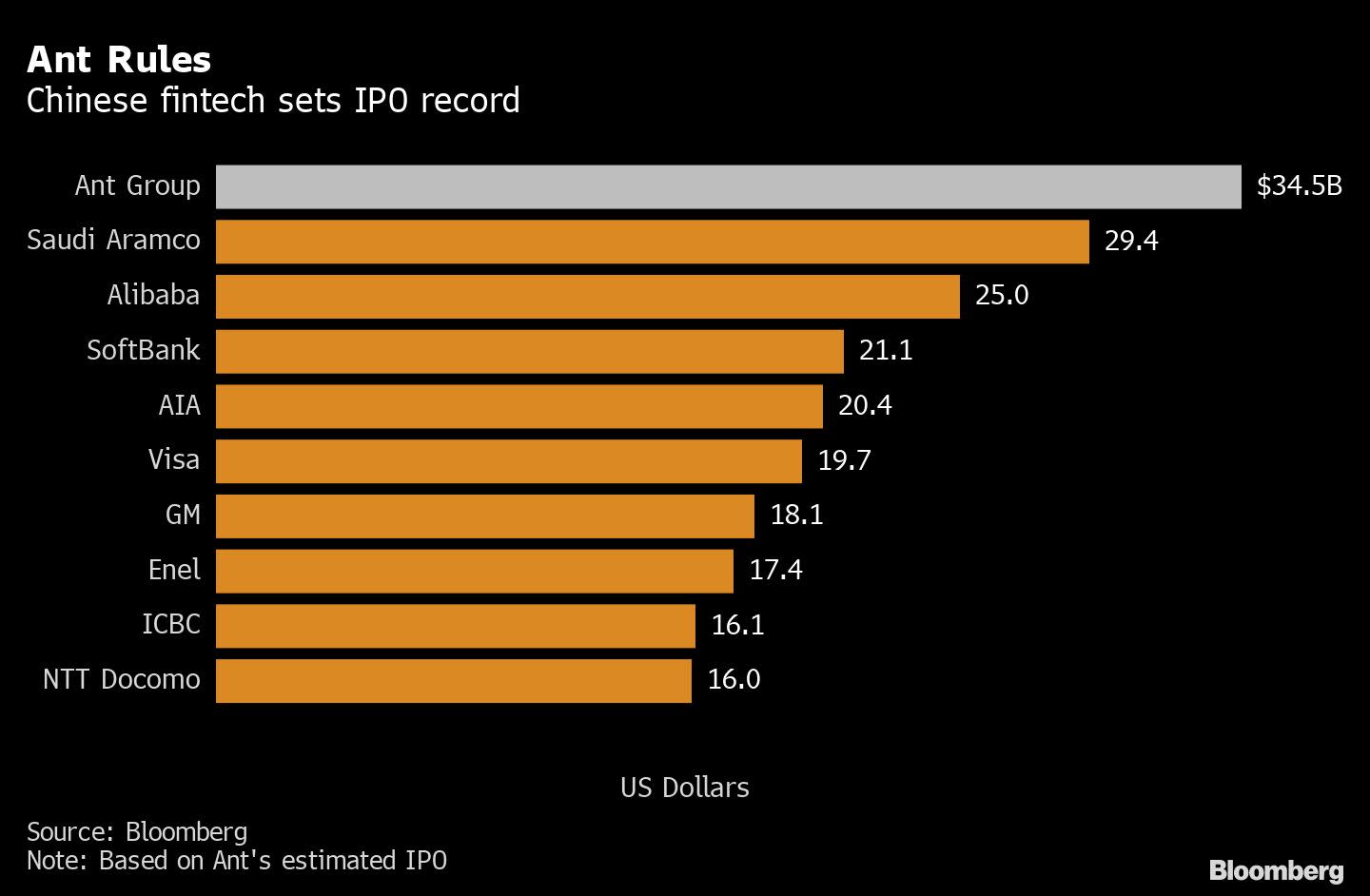

Ant is seeking to raise about $34.5 billion through IPOs in Shanghai and Hong Kong, a blockbuster listing that will be the biggest IPO ever and make it one of the most valuable finance firms on the planet.

The operator of the Alipay platform will have a market value of about $315 billion based on filings Monday, bigger than JPMorgan Chase & Co.

This is “a homecoming for capital markets in Shanghai and Hong Kong,†said John Ho, founder of Janchor Partners.

Ho, who invested $400 million in Ant two years ago, said he’s trying to get more Hong Kong shares, adding that being able to invest in Ant “is priceless.â€.

In the preliminary price consultation of its Shanghai IPO, institutional investors subscribed for over 76 billion shares, more than 284 times the initial offline offering tranche, according to Ant’s Shanghai offering announcement.

Hong Kong stockbrokers are so confident the IPO will go smoothly that they’re offering to let mom-and-pop investors buy the stock with as much as 20 times leverage.

Ant priced its Shanghai stock at 68.8 yuan ($10.27) apiece and its Hong Kong shares at HK$80 ($10.32) each.

The company may raise another $5.17 billion if it exercises the option to sell additional shares to meet demand, known as the greenshoe.

Ma’s 8.8% stake is worth $27.4 billion based on the stock pricing in Hong Kong and Shanghai.

Existing Ant shareholders won’t be able to sell shares for six months, according to the filings.

(Bloomberg) -- With the final stretch of the election upon us, it’s still nearly impossible to guess how the stock market will react to next week’s vote.

While a number of traders have come to consider a Democratic sweep followed by a prompt fiscal deal among bullish scenarios for the equity market, Lakos-Bujas disagrees, seeing Trump’s victory as the most favorable outcome.“A ‘Blue Sweep’ scenario is expected to be mostly neutral in the short term,†JPMorgan’s strategists including Lakos-Bujas said in a report dated Friday.

The firm added that solar manufacturing “will be a cyclical industry with limited tailwinds,†whereas for residential solar, “any multiple expansion/shrinking will rather be driven by supply/demand mismatch.â€Sectors in Focus:Dunkin’ Brands shares are up 18% premarket after the Dunkin’ Donuts and Baskin-Robbins parent company confirmed Sunday afternoon that it has held preliminary discussions to be acquired by Inspire Brands.Cenovus Energy on Sunday agreed to buy Husky Energy in a C$3.8 billion all-stock deal that will combine two of the largest players in Canada’s beleaguered oil-sands industry.

A San Francisco judge refused to pause her September order blocking Trump’s ban on Tencent Holdings Ltd.’s WeChat.Carlyle Group is nearing an agreement to acquire Siemens AG’s Flender mechanical drive unit for about $2.4 billion, according to people familiar.

Airbnb is splitting its privately held shares ahead of a planned initial public offering, according to an internal email.The Los Angeles Dodgers defeated the Tampa Bay Rays on Sunday night to be just one win away from their first World Series title since 1988.

Pfizer's CEO Albert Bourla has said the company could release data on whether or not the vaccine works as early as this month, but the company said in a presentation that the independent data monitoring board which will determine whether or not the trial has been successful has not conducted any interim efficacy analyses yet.

Hasso Plattner, chairman and co-founder of SAP, bought shares worth nearly $300 million in the German software company on Monday after a once-in-a-generation price slide triggered when management dumped its profit targets.

The 76-year-old billionaire bought shares worth 248.5 million euros ($294 million) at an average price of 101 euros, according to a regulatory filing published on Tuesday.

Securities and Exchange Commission.What Happened: The automaker said it paid Musk $3 million for 90 days worth of coverage -- up to a total of $100 million -- but didn't further extend the agreement."Following the lapse of the 90-day period, we did not extend the term of the indemnification agreement with our CEO and instead bound a customary directors' and officers' liability insurance policy with third-party carriers," Tesla said in a statement.The Palo Alto-based company didn't reveal which carrier it has opted for to provide coverage, or the premium it was paying for the D&O policy.Why It Matters: It is "highly unusual" for a company to replace a D&O policy with a guaranty from a company officer "for any period of time," Kevin Hirzel, a managing member of the Detroit-based Hirzel Law firm, told CNBC, which earlier reported the news."Tesla's board did the right thing in obtaining a traditional directors' and officers' liability insurance policy from a third-party insurer," said Hirzel.Charles Elson, a professor of corporate governance, said that the personal indemnification by a CEO "linked the directors too closely to the CEO.""Such a linkage would make it more difficult for board members to exercise good oversight on behalf of all shareholders," Elson told CNBC.Price Action: Tesla shares traded 0.9% lower at $416.50 in the after-hours session Monday after closing mostly unchanged at $420.28.Photo by TED Conference on FlickrSee more from Benzinga * Click here for options trades from Benzinga * Geely Plans To Make 30,000 Polestar EVs Annually At New China Plant: Report * Tesla Set To Be 'One Of The Biggest Winners' In A Biden Presidency, Says Analyst(C) 2020 Benzinga.com.

gambling industry.The world’s largest casino company, Sands is working with an adviser to solicit interest for the Venetian Resort Las Vegas, the Palazzo and the Sands Expo Convention Center, which together may fetch $6 billion or more, said the people, who asked to not be identified because the talks are private.

“It is 15% of revenue but 80% of regulatory pain and burden.â€A recovery in Asia helped improve Sands’ operating results in the third quarter, Adelson said in an earnings call last week.

In Singapore, Marina Bay Sands had a profitable quarter as operations progressively resumed across the resort during the summer.The money from a sale could allow the company to fund other development opportunities.

He added the caveat that it’s not clear who would buy the casinos.Adelson is chairman, chief executive officer and the majority shareholder of Las Vegas Sands, which has a market value of $37.5 billion.Casinos in Macau, the world’s biggest gambling market, generated 63% of the company’s $13.7 billion in revenue last year, before the pandemic struck.

Sales of Keytruda, which is an approved treatment for cancers including non-small-cell lung cancer, rose 21% to $3.7 billion, above analysts estimates of $3.66 billion, according to six analysts polled by Refinitiv.

Defense contractor Raytheon Technologies said its third-quarter net income slumped to $264 million, or 17 cents a share, from $1.15 billion, or $1.33 a share, while sales rose to $14.74 billion from $11.37 billion.

On an adjusted basis that excludes a gain on dispositions, intangible amortization and a charge on the current economic environment, Raytheon said it earned 58 cents a share.

Analysts polled by FactSet expected earnings of 50 cents a share on sales of $15.06 billion.

The company inhabits the mortgage-backed security niche, with $104 billion in total assets, primarily mortgage securities backed by Freddie Mac and Fannie Mae.

The 5-star analyst pointed out, “The combination of dividends paid during the [second] quarter and the sterling book value gain—the company’s best quarterly gain since the Great Recession of 2008-09 [...] We believe NLY shares should trade at a meaningful premium to peers based on the company’s size, scale, and, now, its internal management structure."DeLaney rates the stock an Outperform (i.e. Buy) along with an $8.50 price target.

(To watch DeLaney’s track record, click here)Overall, there have been 8 recent analyst reviews of NLY shares, breaking down to 5 Buys and 3 Holds, giving the stock an analyst consensus rating of Moderate Buy.

(See NLY stock analysis on TipRanks)StoneCastle Financial (BANX)Next up, StoneCastle, is a management investment company, with a portfolio that includes moves into alternative capital securities and community banks.

The company focuses its investment activity on capital preservation and current income generation, committing to returning profits to shareholders.

StoneCastle’s investment portfolio totals over $133 million, of which 32% is credit securitization, 26% is debt securities, and 15% is term loans.During the second quarter, BANX saw over $2.6 million in net investment income, coming out to 41 cents per share.

The company’s net asset value rose to $20.27 per share at the close of the quarter; that figure was $20.93 by September 30.BANX paid out a 38-cent quarterly dividend in Q2, a payment which the company has held up reliably – with one blip upwards in December 2018 – for the past three years.

“The company invested a healthy $36M during the [second] quarter, which included some higher yielding and more attractive securities, which drove the sequential increase in net investment income… Given a strong quarter of investing, particularly into attractive yielding securities, net investment income stepped up solidly in 2Q20.

The company has felt a serious hurt from the ongoing corona crisis, and reported a net loss of 25 cents per share for the calendar second quarter this year.

The company has been gradually raising the quarterly payout for the past three years, and the current dividend, of 22 cents per common share, annualizes to 88 cents and gives a yield of 7.1%.

The company also has said that September quarter results will include a noncash benefit of $900 million due to an adjustment in the useful life of some hardware